The Facts About Invoice Factoring Uncovered

Table of ContentsSome Of Invoice FactoringAn Unbiased View of Invoice FactoringSome Ideas on Invoice Factoring You Should KnowThe Single Strategy To Use For Invoice Factoring

You might likewise refer Factoring as accounts receivable factoring, invoice factoring, as well as often incorrectly balance due financing. Accounts receivable funding is a type of asset-based borrowing (ABL) utilizing a company's accounts receivable as collateral. The Factoring Process Your B2B or B2G company provides products or solutions to bigger creditworthy consumers and also send proper billings.

The factoring company after that pays the balance of the invoice back to the B2B or B2G firm minus a charge. When understanding invoice factoring, it is crucial to keep in mind that factoring differs from borrowing in firms offer balance dues instead of just offer as collateral. The web outcome is that your business can transform its receivables right into instant operating cash.

Non option factoring uses the included advantage of protection versus insolvency or bankruptcy. Just the ideal, most experience factoring firms are able to offer non option to their consumers. This is specifically vital in today's financial setting of uncertainty. Expect the unanticipated as company owners need to be attentive in safeguarding their own rate of interests and also source of incomes.

See This Report about Invoice Factoring

Your company receives the cash it requires when it requires it, so you can best manage your company. invoice factoring. Invoice factoring can be an exceptional option for companies that need cash rapidly however who aren't able to secure a standard small business loan. Several describe organization factoring by several names such as receivables factoring, billing discounting, billing factoring, and borrower funding.

Elements will certainly desire to be confident that these companies have a history of paying their bills. The aspect will likewise give non-recourse factoring. Non-recourse shields your firm when it comes to your customer going financially troubled throughout the purchase period. Fully recognizing invoice factoring is a great means for companies to instill money right into their service without taking on additional debt.

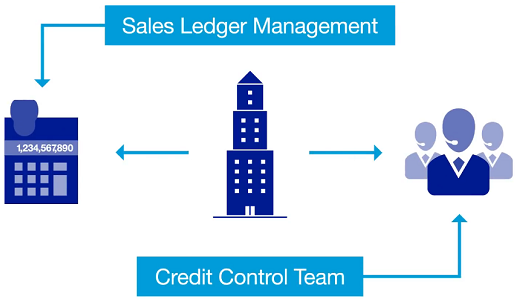

Invoice factoring is often referred to as 'factoring', or 'financial obligation factoring'. It is an economic product that makes it possible for companies to sell unpaid billings (accounts receivable) to a third-party my latest blog post factoring business (a variable). The factoring business buys the invoices for a percentage of their total worth and then takes obligation for accumulating the next page billing payments.

The basic steps are as complies with: You submit details of your invoices to the variable to determine if you are qualified for the factoring facility. The billing factoring business will certainly after that evaluate how risky they really feel the finance is (this is market details, along with about your specific customers) and also will after that give you their quote.

The Best Strategy To Use For Invoice Factoring

The aspect will certainly then begin collection of the invoice with your customersOnce the invoice has actually been gathered, the factor will certainly pay you the staying equilibrium of your money, minus their fee Summary After eligibility is developed, the factoring company will purchase the unsettled invoices for a percentage of their worth and afterwards take control of the debt collection process.

In analyzing qualification, factoring business will take a look at a number of elements, consisting of: The size and also beginning of the billings you're seeking payment forTime framesPotential risksYour very own firms credit scores score as well as track record This last factor to consider is less essential since the genuine danger for the variable lies with the reliability of the organization owing the exceptional billing.

Invoice Factoring for Beginners

Invoice financing can be perfect for brand-new companies, start-ups and also also firms with poor credit score, as a way of achieving financing better. The prices may simply be a little higher, as a result for much less well-known services, or those with bad credit scores. Recap Yes. Any type of company can make use of invoice factoring, yet it might just be appropriate where billings are taking 30-90+ days to make money, to assist with cash-flow.